WORD NEWS

UK home costs rise after seven months of falls; Uber revenues soar; eurozone inflation rises to 7% – enterprise stay | Enterprise

Introduction: UK home costs rise in April after seven consecutive falls

Good morning, and welcome to our rolling protection of enterprise, the world financial system and the monetary markets.

UK home value development picked up in April, constructing society Nationwide reviews this morning, with the primary month-to-month enhance in seven month.

Common home costs rose by 0.5% final month, Nationwide’s knowledge exhibits, following seven consecutive falls going again to final September.

The common value elevated to £260,441, up from £257,122 in March.

This has lifted the annual price of home value development to -2.7%, from -3.1% in March (the most important fall since 2009), as calm returned to the markets after the chaos of final autumn’s min-budget.

Robert Gardner, Nationwide’s chief economist, reviews there have been “tentative indicators of a restoration” out there final month, though this nonetheless leaves costs 4% under their August 2022 peak.

Gardner explains:

“Latest Financial institution of England knowledge means that housing market exercise remained subdued within the opening months of 2023, with the variety of mortgages authorised for home buy in February practically 40% under the extent prevailing a 12 months in the past, and round a 3rd decrease than pre-pandemic ranges.

Nonetheless, in latest months trade knowledge on mortgage functions level to indicators of a pickup.

Final month, Rightmove reported that asking costs had been at file ranges:

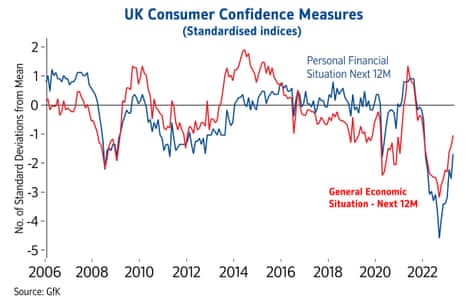

Gardner says the latest pick-up in UK client confidence could also be serving to the housing market, however cautions that….

….any upturn is more likely to stay pretty pedestrian, as it can take time for family funds to get well, since common earnings have been failing to maintain tempo with inflation, and by a large margin over the previous couple of years.

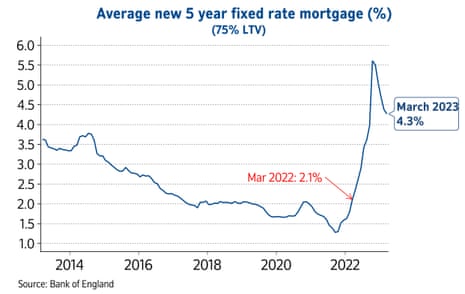

Mortgage rates of interest are additionally more likely to act as a headwind. Whereas they’re nicely under the highs seen within the wake of the mini-Finances final 12 months, charges are nonetheless greater than double the extent prevailing a 12 months in the past.

Additionally developing right this moment

Britain’s greatest supermarkets are going through requires the UK’s competitors watchdog to analyze claims of profiteering amid the price of dwelling disaster, as meals value inflation soared to a file excessive in April.

In a single day, Australia’s central financial institution has stunned traders by elevating rates of interest once more.

The RBA board raised its money price 25 foundation factors to three.85% at its month-to-month assembly on Tuesday, defying traders who had guess the central financial institution would lengthen its pause for a second month.

Greater rates of interest elevate income at banks….. corresponding to HSBC, which has reported a three-fold soar in earnings within the final quarter, On a relentless forex foundation, HSBC’s revenue earlier than tax elevated by $9.0bn to $12.9bn, main the financial institution to launch as much as $2bn of share buybacks and a ten cent-per-share dividend.

BP has defied an easing in vitality costs to put up one of many largest first-quarter income in its historical past, reigniting a debate over windfall good points by oil and fuel corporations.

The vitality large mentioned its underlying income hit $5bn (£4bn) within the first three months of the 12 months, outstripping analysts’ forecasts. Extra on this shortly…

The most recent manufacturing facility PMI reviews will present how producers within the UK and the eurozone fared in April. That follows a shock contraction in China’s manufacturing facility output, reported on Sunday.

We get the newest eurozone inflation report this morning, with costs anticipated to have risen by 7% within the 12 months to April, up from 6.9%. Core inflation might stick at 5.7%, worryingly excessive for the European Central Financial institution.

The agenda

-

7am BST: Nationwide home value index for April

-

9am BST: Eurozone manufacturing PMI for April

-

9.30am BST: UK manufacturing PMI for April

-

10am BST: Eurozone core inflation price on April

-

3pm BST: US Manufacturing unit Orders for March

Key occasions

Uber has delivered a uncommon earnings beat right this moment, because of robust trip and supply demand, says Adam Vettese, analyst at social investing community eToro.

Vettese explains:

This inventory is perennially underwhelming for traders, particularly when you think about the constant lack of precise income. However executives on the agency will probably be pointing gladly to their shock EBITDA numbers as an indication that profitability is simply a few stops away.

“Shrinking losses from $5.93 billion to simply $157 million isn’t any imply feat however there are some one-off outliers within the distinction because the agency noticed heavy funding losses in Q1 final 12 months that flatter to deceive with these figures. That being mentioned, the agency has vastly improved free money circulation, now a file $549 million, a key determinant of underlying well being.

“When it comes to its core companies, demand has been sustained regardless of worries over shoppers curbing spending – one thing we’re starting to see throughout journey and transport shares. It additionally says it has handled a number of the crippling driver shortages of latest months. The following signpost for cautious traders is whether or not a possible recession and ensuing job losses will flag down demand the place zooming inflation didn’t cease it.”

Pfizer’s Covid-19 vaccine gross sales slide

Declining gross sales of Pfizer’s Covid-19 vaccine have knocked its revenues this 12 months.

Pfizer has reported a 29% drop in revenues within the first quarter of 2023, to $18.282bn from $25.661bn.

Revenues from Comirnaty, its Covid-19 vaccine, fell by 75% to $3.06bn from $13.227bn in Q1 2022.

Pfizer says the autumn in Comirnaty gross sales was largely as a consequence of decrease contracted deliveries and demand in worldwide markets, in addition to decrease US authorities contracted deliveries.

However gross sales of Paxlovid, its Covid-19 antiviral remedy, rose to $4.07bn from $1.47bn a 12 months earlier.

Dr. Albert Bourla, Pfizer’s chairman and chief government officer, mentioned an “unprecedented quantity” of recent product launches had been being deliberate, with most due within the second half of 2023.

Bourla says:

We have now made glorious progress towards this aim already this 12 months with the U.S. approvals for Zavzpret, Cibinqo for adolescents and Prevnar 20 in pediatric sufferers, and regulatory submitting acceptances for a Braftovi + Mektovi sNDA, sNDA for the Talzenna and Xtandi mixture, elranatamab BLA and our RSV maternal vaccine candidate — which, if authorised, can be the primary vaccine for administration to pregnant people to assist shield towards the problems of RSV illness in infants from start as much as six months of age.

Shares in Uber have jumped 8% in pre-market buying and selling after it reported greater revenues than anticipated, and a smaller loss (see earlier put up).

Victoria Scholar, head of funding at interactive investor, explains:

“Uber reported first quarter income of $8.82 billion, forward of expectations for $8.72 billion. Quarterly gross bookings grew 19% to $31.4 billion or 22% on a relentless forex foundation. The trip hailing app reported a quarterly loss per share of $0.08, beating forecasts for a lack of $0.09.

Uber Eats has been efficiently broadening its providing, shifting extra in the direction of alcohol and groceries to assist navigate the financial storm clouds because the softening client seems to be to make cutbacks on non-essential spending like takeaways amid cost-of-living pressures.

Like an organization that sells ice lotions and umbrellas, Uber has a really nicely diversified enterprise mannequin with its taxi and meals supply providing. This helped Uber to navigate the pandemic significantly better than trip hailing rivals, because of its meals supply enterprise Uber Eats which was a stay-at-home covid-proof winner whereas journey floor to a halt.

Nonetheless each taxi companies and meals supply are more likely to face headwinds from the difficult macroeconomic backdrop with slowing financial development, value inflation pressures and weak actual wage development. Nonetheless, this has boosted demand for jobs within the gig financial system with a better provide of potential staff on the lookout for supplementary earnings prepared to tackle roles at Uber.

For traders, shares had a tricky time from the height in April 2021 to the trough in July 2022 caught up within the US ‘tech wreck’ on the again of rising inflation and the Fed’s aggressive price mountaineering path. Consequently, Uber has been specializing in slicing prices. Off the lows, Uber has been rebounding with good points extending pre-market. The inventory is up over 29% in 2023 till yesterday’s shut and up an extra 8% this morning. The learn throughout can also be offering a lift to shares in ride-hailing rival Lyft.”

Uber( $UBER ) simply launched their earnings report ♨️

🪙 EPS -$0.08 (Est -$0.09)🔺BEAT

💵 Rev $8.82B (Est $8.72B)🔺BEAT📌

– Complete rev up +29% y/y

– Mobility rev up +72% y/y

– Freight rev down -23% y/y

– Op loss down -46% y/y

– Op loss -$262M pic.twitter.com/o4Y1RxvnH2— Earnings Pizza (@earningspizza) Could 2, 2023

Uber revenues surge

Uber, the trip rent and meals supply group, has grown its revenues by round a 3rd, serving to it to slim its web loss.

Uber’s gross bookings grew 19% year-over-year to $31.4bn in January-March, together with a 40% rise in mobility gross bookings and eight% in gross bookings for deliveries.

Journeys through the quarter grew by 24% year-on-year to 2.1bn, or roughly 24 million journeys per day on common. That lifted revenues to $8.8bn, up 29% in contrast with the primary quarter of 2022 when the Covid-19 pandemic was hitting demand for journeys.

On an adjusted EBITDA foundation, earnings rose 350% to $761m.

However the agency made a web lack of $157m within the quarter, a pointy enchancment on the $5.9bn loss in Q1 2022, and a smaller loss than anticipated.

$UBER Earnings:

– Income grew 29% YoY to $8.8 billion, or 33% on a relentless forex foundation

– GAAP EPS of -$0.08

– Web loss attributable to Uber Applied sciences, Inc. was $157 million, which features a $320 million web profit (pre-tax) primarily as a consequence of web unrealized good points associated… pic.twitter.com/EnO7PwvT06— AlphaSense (@AlphaSenseInc) Could 2, 2023

Dara Khosrowshahi, Uber’s CEO, says:

“We considerably accelerated Q1 journey development to 24% from 19% final quarter, with Mobility journey development of 32%, on account of improved earner and client engagement.

“Trying forward, we’re targeted on extending our product, scale and platform benefits to maintain market-leading high and bottom-line development past 2023.

Final summer time, the Uber Recordsdata confirmed how the corporate broke the legislation, duped police and regulators, exploited violence towards drivers and secretly lobbied governments internationally because it expanded quickly.

Vice Media Group, the corporate behind well-liked media web sites corresponding to Vice and Motherboard, is getting ready to file for chapter, the New York Occasions reported on Monday, citing folks with data of its operations.

The report comes days after Vice shuttered its Vice Information Tonight program, and amid waves of media layoffs and closures, together with the finish of BuzzFeed Information.

Vice has acquired curiosity from 5 firms and would possibly take into account a sale to keep away from chapter, the Occasions report mentioned, including that within the occasion of a chapter, which might occur within the coming weeks, Vice’s debt holder Fortress Funding Group might find yourself controlling the corporate.

Extra right here:

The shock rise in UK home costs, by 0.5% in April, reported this morning is lifting confidence that the property sector has stabilised.

Nicky Stevenson, managing director at property agent group Nice & Nation, mentioned:

“This increase in exercise can also be coinciding with rising inventory ranges and, with property transactions beginning to tick up, these are nice indicators of accelerating confidence within the property market.”

Chris Barry, director at Gloucester-based conveyancer Thomas Authorized, mentioned:

“Sure, there’s a lengthy option to go and the potential for turbulence forward however April’s Nationwide home value knowledge is encouraging.”

Iain McKenzie, chief government of the Guild of Property Professionals, mentioned:

“The specter of an aggressive fall in property gross sales has didn’t materialise and we’re beginning to see extra mortgage functions being authorised.”

ING: Extra price rises probably as eurozone inflation rises

The rise in eurozone inflation in April, to 7%, exhibits that value pressures stay sticky within the euro space, says Carsten Brzeski, international head of macro at ING.

This underlines the necessity for additional price hikes, albeit at a slower tempo and smaller magnitude than earlier than, Brzeski predicts.

He expects the ECB to lift rates of interest once more, on Thursday, by one other quarter-of-one-percent, or 25 foundation factors.

Over the past 12 months, inflation within the eurozone, which began as a supply-side situation, has change into a demand-side situation. This can be a clear invitation for the ECB to proceed mountaineering rates of interest. Whereas there may be little or no a central financial institution can do to decrease oil costs or to cease a conflict, there’s loads a central financial institution can do to cease an excessive amount of cash chasing too few items: convey down demand. And that is precisely what the ECB will proceed doing on Thursday. Even when headline inflation has come down and can come down additional, this isn’t but the second of reduction. The ECB doesn’t need to repeat the earlier mistake of underestimating inflation and can due to this fact be prepared to go too far, even when this ultimately seems to be a coverage mistake.

The one open query is whether or not the ECB will go for 25bp or 50bp. Out within the open, solely Austrian central financial institution governor Robert Holzmann has been advocating 50bp. The opposite hawks, like Isabel Schnabel, lately left the choice of 50bp open however didn’t formally subscribe to it.

Regardless of the rise in general inflation within the eurozone, there was a shocking transfer downwards in meals inflation, as economist Kamil Kovar of Moody’s Analytics explains:

The most important draw back shock in #eurozone #inflation got here from meals costs, which recorded general small decline from earlier month.

Mixed with massive base impact from final 12 months, we received massive decline in y/y, from 15.5% to 13.6%.

This was first because the surge began… pic.twitter.com/tC7GK4oRhn

— Kamil Kovar (@CrisisStudent) Could 2, 2023

Whereas the magnitude and timing was shocking, the truth that meals costs had been comfortable was not.

It was actually only a payback from the loopy jumps in Feb and Mar, which we knew is coming. What we didn’t know is that a lot of it can are available April.

— Kamil Kovar (@CrisisStudent) Could 2, 2023

The excellent news is that extra is in retailer.

Latest decline leaves unprocessed meals costs nonetheless up on the 12 months. Good likelihood all of this, and perhaps extra, will probably be undone in coming months. pic.twitter.com/nbF2yZQMzb

— Kamil Kovar (@CrisisStudent) Could 2, 2023

The products information on unprocessed meals shouldn’t conceal the opposite excellent news in meals.

When it comes to SA m/m, processed meals had smallest enhance since starting of final 12 months.

Once more, we anticipated moderation, however we could be getting it sooner/quicker than we thought.

— Kamil Kovar (@CrisisStudent) Could 2, 2023

Right here’s Daniel Kral, senior economist at Oxford Economics, on the rise in eurozone inflation:

The small rise in Eurozone headline inflation in April was not purported to occur. In the meantime core inflation was down solely marginally. The @ecb will not be carried out… pic.twitter.com/iw4ZFCL3tZ

— Daniel Kral (@DanielKral1) Could 2, 2023

Eurozone ‘not out of the woods’ as inflation rises

Inflation throughout the euro space has risen, as the price of dwelling squeeze hit households throughout Europe.

Euro space annual inflation is anticipated to be 7.0% in April 2023, up from 6.9% in March, in response to a flash estimate from statistics workplace Eurostat.

Power costs rose, by 2.5% in contrast with April 2022, up from a 0.9% year-on-year drop in March.

Meals, alcohol & tobacco is anticipated to have the very best annual price in April, at 13.6%, down from 15.5% in March, whereas non-energy industrial items inflation slowed to six.2%, from 6.6%.

However companies inflation rose, to five.2% from 5.1% in March.

Rising inflation places extra stress on the European Central Financial institution to lift rates of interest once more, when it meets later this week.

However the ECB will probably be happy to see that core inflation eased. Client costs, excluding vitality, meals, alcohol & tobacco, rose by 5.6% within the 12 months to April, down from 5.7%/12 months in March.

Daniele Antonucci, chief economist & macro strategist at Quintet Personal Financial institution, says inflation is way too excessive for the ECB to really feel snug that it’s quickly converging to focus on.

Opposite to the US Federal Reserve, which we anticipate to ship a remaining price hike this week earlier than pausing to asses the affect of tighter monetary situations and banking-sector stresses, there are extra price will increase on the playing cards within the euro space.

With core inflation greater than 5.5 per cent, it seems to be as if the euro space could have a worse inflation downside than the US. For this reason we suspect the European Central Financial institution will reiterate that its job isn’t carried out simply but at this week’s press convention.

With credit score situations tightening and separate knowledge revealing that the European client is getting squeezed, we additionally suspect that the near-term outlook stays fairly difficult, with development mainly stagnating on the entire.

Whether or not this results in a pause in central financial institution charges this aspect of the Atlantic too stays to be seen. For now, we predict the motivation is to proceed to make financial coverage extra restrictive over the subsequent few months.

That is more likely to result in additional bouts of market volatility and financial weak spot. Although euro space development has held up considerably higher than envisaged firstly of the 12 months, we’re not out of the woods simply but.

UK manufacturing facility downturn: what the consultants say

The additional contraction in UK manufacturing in April “makes for gloomy studying”, says Dr John Glen, Chief Economist on the Chartered Institute of Procurement & Provide.

However there’s a silver lining, he factors out – falling demand led to an easing of each provide and inflationary pressures on the sector.

Glen says post-Brexit prices pushed down abroad demand:

The general downturn was pushed by subdued market sentiment and shopper value slicing, with client and intermediate items producers hardest hit. Falling exports demonstrated diminishing demand from EU, US and China for UK manufacturing in response to ongoing Brexit and trade-related prices.

The funding items sector was the one notable vibrant spot, with export order development hitting a 20-month excessive. “The lull in manufacturing exercise did present respiratory area for provide bottlenecks to work their approach out of the system, with improved materials availability and shorter supply instances being reported.

Whereas there may be nonetheless uncertainty concerning the future and potential for additional geopolitical instability to destabilise commerce flows, there may be hope that we’re coming to the top of the numerous provide chain disruption which has gripped the sector for the final three years.”

Maddie Walker, Trade X lead at Accenture UK, says the slowdown in rising prices is encouraging:

“These outcomes are a reminder that it’ll be a rocky highway to restoration for the UK’s manufacturing sector. Nonetheless, it’s constructive to see an optimistic outlook remaining amongst firms, with widespread expectation that output will rise through the coming 12 months. It’s additionally encouraging to see value will increase beginning to sluggish in addition to supply instances shortening, in an indication that a number of the provide chain points which have outlined the sector for the previous few years are beginning to ease.

Continued funding into provide chain resilience, digitisation and modernising the workforce will assist stabilise producers and place the sector nicely for a return to development as soon as demand improves.”

Rising rates of interest and inflation have dampened demand for manufactured items, factors out Glynn Bellamy, UK Head of Industrial Merchandise at KPMG:

“Provide has improved and a few enter prices have fallen, but the UK manufacturing sector is struggling in comparison with some elements of the financial system – as home and export demand for manufactured items stays subdued by the price of dwelling disaster and short-term demand is adversely impacted by de-stocking in provide chains. The latter is the unfavourable aspect of the easing of provide chain pressures and the unwind of the profit many producers skilled in 2021 and 2022 as there was a drive to construct security inventory ranges. Manufacturing volumes have subsequently fallen, costing jobs within the sector.

“While some enter prices have fallen, UK vitality costs stay considerably in extra of these in North America and the Far East, inserting ongoing stress on UK competitiveness. Given these dynamics, UK manufacturing wants an upturn in international client confidence to result in extra massive ticket buying, however producers will probably be acutely conscious how risky the worldwide client panorama stays, notably with the continued uncertainty over future rate of interest rises.”

HSBC guidelines out banking disaster as income triple

Kalyeena Makortoff

HSBC’s chief government has denied the opportunity of a contemporary banking disaster, saying the failure of 4 banks in six weeks was a merely an indication of poor danger administration, because the lender tripled its personal first quarter income to $13bn (£10bn) after its rescue of Silicon Valley Financial institution UK.

Noel Quinn’s feedback got here a day after JP Morgan stepped in to purchase many of the collapsed lender First Republic in a $10.6bn takeover, as a part of regulators’ efforts to attract a line underneath lingering turmoil throughout the banking sector.

“We’re happy that there was a decision on First Republic on the weekend in order that that state of affairs has been resolved,” Quinn instructed journalists throughout a convention name on Tuesday.

“We don’t consider that there’s a international banking disaster on the horizon. We predict there are some challenges which were evidenced in a number of the regional banks within the US, however we don’t consider that’s systemic within the US, or throughout all banks.”

First Republic – which focuses on excessive web value shoppers – is the fourth international financial institution to break down since early March, after the failures of Silicon Valley Financial institution, the New York-headquartered lender Signature Financial institution and Switzerland’s second-largest financial institution, Credit score Suisse.

Extra right here:

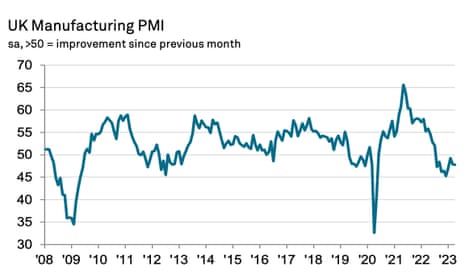

UK manufacturing downturn continues as demand falls

The downturn within the UK manufacturing sector continued in April as factories had been hit by weak demand, the newest survey of manufacturing facility buying managers exhibits.

April’s manufacturing PMI survey exhibits that output and new orders at UK factories contracted final month, because the manufacturing downturn continued.

Output, new orders, employment and shares of purchases all contracted throughout April, with firms reporting a drop in demand, as a consequence of “shopper destocking” as prospects tried to chop their prices.

This pulled the S&P World / CIPS UK manufacturing PMI right down to a three-month low of 47.8 in April, from 47.9 in March, under the 50-point mark displaying stagnation – however higher than the sooner flash estimate of 46.6.

New export orders contracted for the fifteenth consecutive month, with corporations reporting softer demand from the US, China and mainland Europe.

However, there are additionally indicators that provide chain pressures have eased. Producers’ enterprise optimism rose to 14-month excessive, whereas vendor supply instances shortened for the third successive month.

The charges of enhance in common enter prices and output prices each eased in April, falling to 35- and 28-month lows respectively.

The downturn within the #UK manufacturing sector continued in April (#PMI at 47.8; Mar: 47.9) amid sustained contractions in output and new orders. However there’s a silver lining in the truth that provide and inflationary pressures eased on the month. Learn extra: https://t.co/TtSS4TDrnu pic.twitter.com/iub3OFVTXC

— S&P World PMI™ (@SPGlobalPMI) Could 2, 2023

Rob Dobson, director at S&P World Market Intelligence, mentioned:

“The UK manufacturing sector remained within the doldrums firstly of the second quarter. Output and new orders contracted, as producers felt the impacts of shopper uncertainty, destocking and tightening value controls.

There was no escape from the subdued temper of the market, with each home and export prospects remaining reticent to decide to new contracts.

However, the autumn in provider lead time is healthier information, serving to to push down uncooked materials value pressures, Dobson provides:

“Higher-running provide chains have helped producers cut back backlogs of orders, gathered in prior months amid part shortages. However the concern is that these backlogs are being depleted, leaving corporations with much less work in hand.

There could also be some mild on the horizon, as producers stay stoically optimistic concerning the outlook for the 12 months forward. Over 60% of corporations anticipate to increase manufacturing over the subsequent 12 months. However demand might want to choose up within the months forward to warrant any enhance in manufacturing, and with the UK seeing stubbornly excessive home inflation coupled with a worsening export pattern, dangers appear skewed to the draw back.”

Eurozone manufacturing facility downturn deepens, however enter value pressures ease

The eurozone manufacturing facility downturn deepened final month, in response to the newest survey of buying managers, whereas uncooked materials costs have dropped.

The HCOB remaining manufacturing Buying Managers’ Index (PMI), compiled by S&P World, has fallen to 45.8 in April from March’s 47.3. That’s barely higher than the ‘flash’ studying of 45.5, however nicely under the 50 mark separating development from contraction for the tenth month in a row.

The PMI was pulled down by a drop in the price of uncooked supplies, which suggests inflationary pressures are easing. Corporations reported the most important drop in working bills in virtually three years.

This allowed corporations to sluggish their very own value rises; the output costs index fell to a 29-month low of 51.6 from 53.4.

An index measuring output fell under the breakeven mark to 48.5 from 50.4.

Cyrus de la Rubia, chief economist at Hamburg Business Financial institution, says:

“This decline has been pretty broad-based throughout the euro zone, with regional PMI indices in France and Italy additionally displaying a drop in output, whereas output in Germany and Spain was practically stagnant.”

In Germany, retail gross sales have dropped by greater than anticipated, as shoppers in Europe’s largest financial system retrench.

German retail gross sales fell by 2.4% in March in actual phrases from the earlier month, the Federal Statistics Workplace reported this morning, that means retail gross sales had been down 8.6% year-on-year in actual phrases.

Analysts polled by Reuters had predicted a month-on-month enhance of 0.4%.

German retail gross sales stumbled in March falling to 9% under their pre-pandemic pattern on broad weak spot. Seemingly a key motive for Q1 GDP coming in under expectations. Even permitting for some revisions that is a horrible carryover into Q2. https://t.co/P90VdXvWMO pic.twitter.com/JTtAlTu3OL

— Oliver Rakau (@OliverRakau) Could 2, 2023

European monetary markets have made a subdued begin to the brand new month.

The FTSE 100 index was barely greater in early buying and selling, led by rallying housebuilders (see earlier put up), and HSBC (up 4.3% after saying a share buyback following a soar in income).

UK rates of interest might rise as much as 4.75% this 12 months, economist predicts

The shock rise in UK home costs in April is reigniting curiosity in how excessive the Financial institution of England could increase rates of interest this 12 months.

Professor Costas Milas, of the Administration Faculty at College of Liverpool, argues that the BoE might elevate rates of interest to 4.75% this 12 months.

In a brand new blogpost, Professor Milas explains that top public expectations of inflation have the potential of placing further stress on present inflation by way of demand for greater wages.

However this prediction is conditional on monetary stress not escalating additional. If, as a substitute, monetary stress worries take over, UK rates of interest would possibly find yourself under 4% by the top of 2023, he suggests.

Professor Milas says:

In reality, there may be rising expectation that the Chancellor of the Exchequer will enhance the extent for assured UK deposits, from £85,000 at the moment. This means to me that UK regulators are considerably frightened that we’ve got not totally escaped the danger of a monetary/banking disaster.

Due to this fact, I don’t rule out the likelihood that the BoE will reduce UK rates of interest under 4 per cent by the top of the 12 months.

JPMorgan’s transfer (over the weekend) to accumulate most of failed US financial institution First Republic is a (fixed) reminder that monetary stress will not be over.

The total blogpost is right here:

Trending

-

Bank and Cryptocurrency11 months ago

Cheap Car Insurance Rates Guide to Understanding Your Options, Laws, and Discounts

-

Bank and Cryptocurrency11 months ago

Why Do We Need an Insurance for Our Vehicle?

-

entertainement5 months ago

entertainement5 months agoHOUSE OF FUN DAILY GIFTS

-

WORD NEWS12 months ago

Swan wrangling and ‘steamy trysts’: the weird lives and jobs of the king’s entourage | Monarchy