WORD NEWS

How India allowed RP-Sanjiv Goenka corporations to beat coal auctions | Enterprise and Economic system

New Delhi, India – At 11am on January 31, 2015, India’s Ministry of Coal began the net bidding for the Sarisatolli coal mine within the jap state of West Bengal. Nevertheless it didn’t generate warmth within the energy-hungry nation, and the primary bid got here one hour and 37 minutes later from a conglomerate’s agency. Of the 5 corporations that had been eligible to compete, just one saved sparring with the agency. One other made a fleeting look as soon as and the remaining didn’t bid.

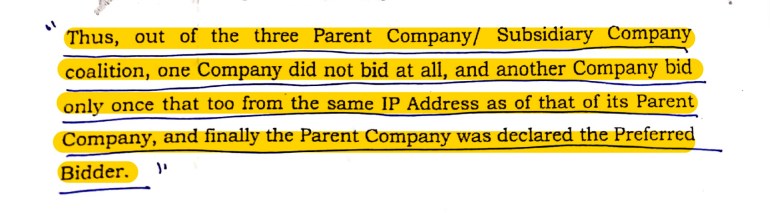

Three of these 5 bidders, together with the winner, belonged to the identical conglomerate, the RP-Sanjiv Goenka (RPSG) group, beforehand undisclosed inner paperwork of India’s prime auditor, the Comptroller and Auditor Basic (CAG), reveal. The group is a $4bn-revenue conglomerate with pursuits in energy, IT, schooling, retail and media.

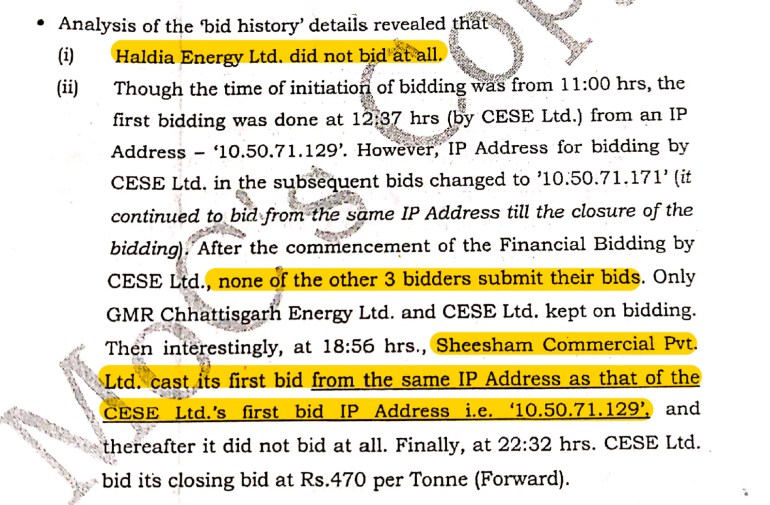

Of the three RPSG subsidiaries, the paperwork confirmed, one didn’t bid in any respect. One other subsidiary, a shell firm the group acquired two days earlier than the public sale, tendered a bid from the identical personal web protocol (IP) deal with utilized by its mother or father firm and the bid-winner, the Calcutta Electrical energy Provide Company (CESC).

The paperwork indicated an absence of bid secrecy, important for getting optimum worth throughout an public sale. Associated entities taking part and speaking with one another through the bidding course of is extensively thought of to be “bid-rigging,” per CAG’s protocols.

CESC had the licence for the Sarisatolli mine till 2014 when India’s Supreme Court docket cancelled it, together with licenses for 203 different mines. Earlier governments, the court docket discovered, had handed out licences illegally and at a pittance, a part of an alleged $22bn coal rip-off. The Narendra Modi-led BJP authorities that rode into energy on an anti-corruption wave that 12 months got down to “transparently” re-auction the mines by way of an digital bidding course of.

The primary a part of our investigation reveals that the brand new administration enabled personal firms to proceed to bypass the aggressive course of to nook giant coal reserves, ignoring a number of warnings from its auditors of loss to the federal government exchequer, because it had underneath earlier governments.

The Sarisatolli mine was a part of the primary lot of auctions the Modi authorities performed at hand over the coal reserves to non-public corporations. The CAG officers red-flagged its public sale and that of 10 different mines to the federal government in its last report on digital auctions of coal mines submitted to Parliament in August 2016. It stated the “potential stage of competitors” was not achieved through the auctions — a bureaucratic euphemism for failed auctions.

An public sale is taken into account profitable when completely different companies compete to get an asset by bidding what they assume is the truthful worth for it with out being conscious of the gives their opponents have made. In a real competitors, the best bidder will get the asset and the vendor receives a good market worth. On this case, it appears this didn’t occur as a result of some corporations could have colluded by way of their subsidiaries to artificially decrease the bids being supplied for the coal block.

CAG’s last report listed the auctions for these 11 mines through which some bidders participated together with their sister corporations. Aside from the RPSG Group, the opposite bidders that employed comparable practices had been Aditya Birla Group’s Hindalco Industries Restricted, Vedanta’s BALCO and OP Jindal Group’s Jindal Energy Restricted (JPL).

Though CAG had proof of RPSG corporations bidding from the identical IP deal with for the Sarisatolli mine, it solely detailed their modus operandi in a “case examine” to exhibit the potential collusion with out their identifiable particulars. It didn’t disclose the identify of the mine or the identities of the bidders within the case examine.

The Ministry of Coal rubbished CAG report findings on the time, and the secrecy across the names of the bidders and the mine served solely to bury the Sarisatolli case.

The Reporters’ Collective (TRC), a non-profit media organisation based mostly in India, accessed inner data of the CAG audit that named RPSG’s subsidiaries and detailed the way it received the mine. The group’s monetary data additionally confirmed that it acquired three shell corporations instantly earlier than the coal auctions, which influenced the auctions of no less than two different mines.

A number of months after these auctions, the Modi authorities internally admitted the public sale course of was “liable to be misused” and guidelines that ruled the auctions may enable bidders to “stifle competitors”. Nevertheless it modified the foundations solely after most “ready-to-use” coal mines had been auctioned. A lot of the winners, together with the RPSG agency, CESC, have continued to function the mines as we speak.

The collective and Al Jazeera despatched detailed inquiries to the RPSG corporations, the coal ministry and the CAG. None responded.

Queries had been additionally despatched to Hindalco, BALCO and JPL. Solely JPL responded, stating that the CAG’s discovering that the potential stage of competitors could not have been reached, “is unfounded”. It stated, “quite the opposite, India’s public sale coverage has attracted good competitors and fetched most premium which has no parallel on the earth” and that its participation within the auctions “has all alongside been in compliance with the tender phrases and situations”.

Stifling competitors

To make sure auctions are aggressive and fetch one of the best fee for nationwide belongings, the coal ministry’s public sale guidelines stated there needs to be no less than three certified bidders within the last spherical after an preliminary screening of candidates.

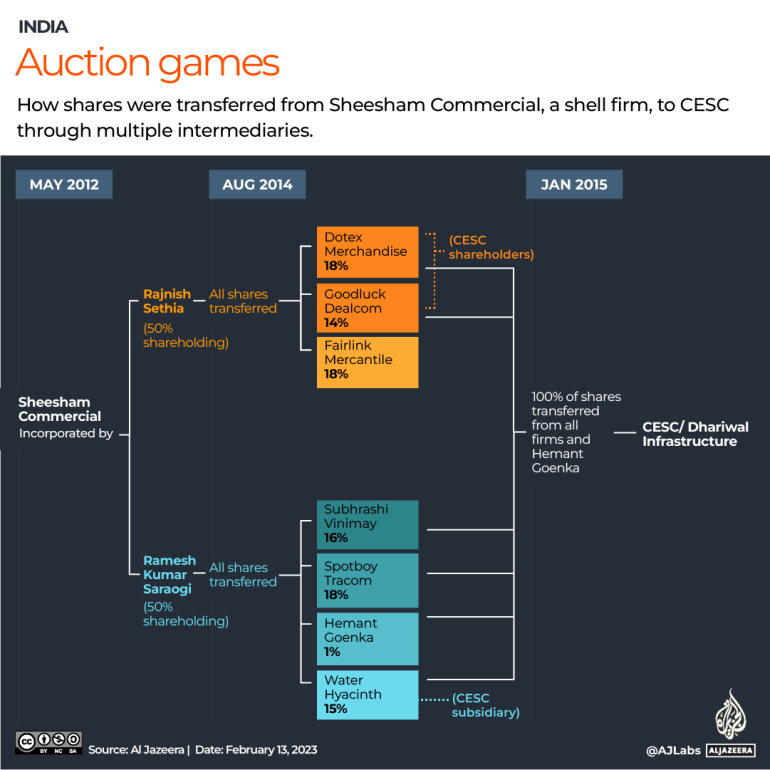

Two days earlier than the due date to use for the public sale of the Sarisatolli coal block in January 2015, CESC, together with two of its subsidiaries Haldia Power Restricted and Dhariwal Infrastructure, acquired the three shell corporations – Sheesham Business Non-public Restricted, Wigeon Commotrade Non-public Restricted and Water Hyacinth Commosale Non-public Restricted.

CESC, together with Sheesham Business and considered one of its older subsidiaries Haldia Power, participated within the public sale of the Sarisatolli block. Two extra bidders — Adani Energy Restricted and GMR Chhattisgarh Power Restricted — had been within the fray within the last spherical to make it a complete of 5 contestants. Adani didn’t bid in any respect and GMR went backwards and forwards with CESC however was outbid.

In late 2015, as the highest auditors of the nation examined the digital logs of bidding data, they discovered that Haldia Power didn’t bid regardless of submitting an preliminary worth supply with a non-refundable price on the screening stage, and Sheesham Business bid as soon as, from the identical IP deal with utilized by CESC.

The public sale guidelines additionally required bidders to specify the ability vegetation they owned and which might use the coal from the mines they’d bid for. The auditors discovered that Sheesham Business, which didn’t personal any energy vegetation, confirmed a unit of a CESC energy plant as its personal end-use plant. Instantly after successful the public sale, CESC requested the coal ministry to permit it to “divert” coal from its mine to the ability plant unit quoted by Sheesham Business. The ministry agreed.

“This was a tailored case of cartelisation,” stated Sudiep Shrivastava, a lawyer and one of many key litigants within the case that led to the cancellation of coal blocks in 2014. “Three corporations from the identical group bid collectively; two intentionally lose the bid and one will get the coal on the low-cost fee. The successful bidder then diverts the coal to the ability plant of the corporate that misplaced the public sale. In impact, the subsidiary, which misplaced the public sale, additionally received the coal on the similar worth as that quoted by the successful firm.”

Net of zero-revenue corporations

CESC’s shell corporations Sheesham Business, Wigeon Commotrade and Water Hyacinth Commosale had been included in Kolkata in Might 2012, two months after a draft CAG report blowing the lid off the previous arbitrary allocations of coal mines was leaked to the press. In response to their incorporation paperwork, their primary “goal” was to hold out mining to provide coal to their shareholders’ thermal energy vegetation.

On paper, nevertheless, the unique shareholders of those corporations had been entities that had no public file of proudly owning any thermal energy plant or hyperlinks with coal companies. The three corporations shared the identical electronic mail deal with and two of them had been registered at a typical postal deal with.

All three corporations turned in the identical actual figures of their steadiness sheets for the monetary 12 months 2013-14, a 12 months earlier than the auctions. The truth is, a number of monetary paperwork of Water Hyacinth had been connected as data for Sheesham Business.

In August 2014, a number of different corporations grew to become shareholders in Sheesham Business and Water Hyacinth. TRC reviewed their monetary statements and located relations existed between a few of these and RPSG.

On January 29, 2015, with 48 hours remaining for the auctions, RPSG’s flagship firm CESC took direct and full management of all three shell corporations.

The three corporations didn’t conduct any enterprise operations for one more monetary 12 months after the coal auctions. The only enterprise exercise on their books till 2016 was taking part within the coal auctions by taking a mortgage from their mother or father group corporations. In June 2016, RPSG modified Sheesham Business’s identify to Kota Electrical energy Distribution Restricted and received its first actual enterprise operation to provide electrical energy. Equally, Wigeon Commotrade’s id was modified to Bharatpur Electrical energy Companies and Water Hyacinth’s identify was modified to Bikaner Electrical energy Provide Restricted, each of which began actual operations, supplying electrical energy.

The flawed rule

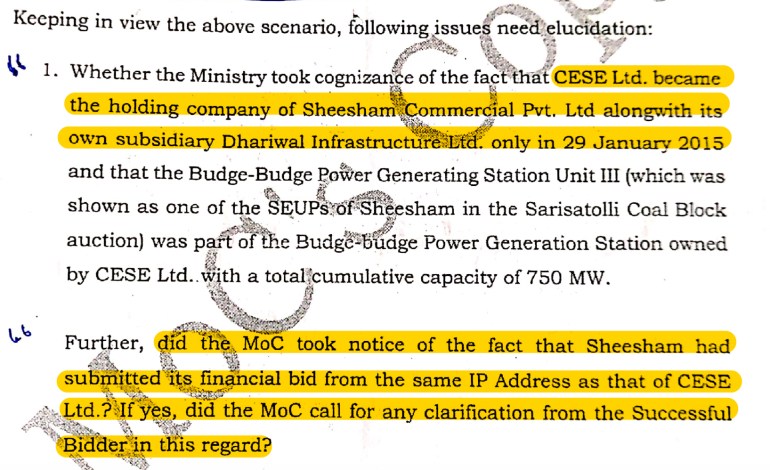

In its October 2015 audit question, CAG requested the coal ministry whether or not it “took cognizance of the truth that CESC Ltd grew to become the holding firm of Sheesham Business Pvt Ltd” two days earlier than the due date for bidding functions for Sarisatolli mine. It additional requested if it knew that each corporations submitted their bids from the identical IP deal with and that Sheesham Business listed CESC’s energy plant unit as its personal within the software. “If sure, did the MoC [Ministry of Coal] name for any clarification from the profitable bidder on this regard?” the CAG requested.

In an inner electronic mail on November 9, 2015, coal ministry officers recorded that the participation of three way partnership corporations and their mother or father corporations with “widespread” end-use vegetation was allowed “in accordance with the tender doc”.

The usual tender doc (STD), which laid out the foundations for conducting auctions, stated all candidates can be first ranked based mostly on their “preliminary worth gives”, which is the price of coal they had been keen to pay to the federal government. Both the highest 50 % of all candidates or the highest 5 bidders, whichever quantity was greater, would then be chosen for the ultimate spherical of bidding.

However the STD additionally had a clause that allowed three way partnership corporations and their mother or father corporations, together with these with widespread end-use energy vegetation, to take part within the public sale as bidders. This ensured that whereas there was a cap on the utmost variety of corporations that might take part within the last bidding, associated corporations which may talk and agree with one another about bid pricing and profit-sharing from the auctions had been allowed to take part.

Inside the first week of auctions in February 2015, when solely 11 mines had been auctioned, one of many bidders challenged the clause within the Delhi Excessive Court docket, arguing that it may result in “cartelisation” amongst bidders and “reducing of ultimate bid worth”. However on February 18, 2015, the court docket dismissed the petition, ruling that, within the auctions performed till then, the “processes had labored effectively” and that it couldn’t discover any “indication or proof” of cartelisation.

The Sarisatolli mine’s inner bidding data had been by no means positioned earlier than the Delhi Excessive Court docket as proof, however the coal ministry repeatedly used the court docket judgement to say earlier than the CAG and in Parliament that there was nothing unsuitable with the public sale course of.

The ministry, nevertheless, later agreed internally that the rule permitting joint ventures and mother or father corporations to take part as competing bidders was flawed and eliminated it.

“It has been felt that this provision is liable to be misused” the ministry had stated whereas recommending the change earlier than the third spherical of auctions in June 2015, the CAG famous.

In later auctions, the ministry thought of all joint ventures and subsidiaries of 1 firm as a single bidder and allowed extra unbiased bidders to take part to keep up competitors.

It, nevertheless, didn’t act on CAG’s findings about suspected collusion by CESC and its subsidiaries utilizing this clause within the Sarisatolli public sale. It by no means responded to the auditors’ particular question searching for clarification on CESC and Sheesham Business submitting bids from the identical IP deal with.

Authorities vs CAG

Although CAG didn’t disclose particular particulars of the Sarisatolli public sale in its last report submitted to Parliament in August 2016, it stated as a result of the federal government allowed joint ventures and subsidiaries to take part as unbiased bidders, efficient competitors in no less than 11 of 29 auctions till then was lowered to between two to a few bidders although extra may need technically certified.

“Additional, in 7 coal mine auctions (27%) the successful bidder was a coalition firm,” it stated. CAG summarised, “Audit couldn’t draw an assurance that the potential stage of competitors was achieved throughout Stage II bidding of those coal mines.”

To determine the federal government’s response to the CAG’s report, TRC accessed by way of Proper to Data queries the coal ministry’s Motion Taken Notice, a proper response submitted to Parliament in response to CAG’s findings.

Within the notice, the ministry stated the availability to permit subsidiaries and mother or father corporations as unbiased bidders “was a results of a effectively thought out course of based mostly on a logical evaluation of bidding behaviour”.

It additional elaborated that “even assuming that bidders for a selected mine belong to the identical firm, a few of them would nonetheless should bid aggressively with the intention to qualify within the prime 50%”.

The CAG, in its response, identified the ministry was defending the identical clause it had discovered to be “liable to be misused” by bidders and altered later. It stated the ministry had no “particular reply” relating to the 11 circumstances, together with Sarisatolli, through which the CAG couldn’t decide if the potential stage of competitors was achieved.

The ministry’s Motion Taken Notice, together with the CAG’s remarks submitted to Parliament, has to this point not been taken up for dialogue or acted upon. The CAG, too, didn’t comply with by way of with the investigation within the 11 circumstances that it suspected of rigging.

Anil Swarup, the previous coal secretary who oversaw the public sale, solid doubt on the findings of CAG. In his memoir, Not Only a Civil Servant, he boasted that the federal government ensured lots of CAG’s preliminary findings didn’t make it to the ultimate report tabled earlier than Parliament.

Shashi Kant Sharma, the previous CAG who oversaw the 2015 audit of the coal auctions, didn’t reply to requests from the collective for an interview.

Quick ahead to the longer term

As soon as the federal government modified the rule, and with most “prepared to make use of” mines taken within the first two rounds, few bidders confirmed curiosity within the following auctions and the federal government may public sale solely two extra mines to non-public gamers till 2020.

That 12 months, New Delhi eliminated the restriction on the bidders to make use of the coal in their very own vegetation. After the change, they might mine the coal to promote on the open market. With this rest, 43 coal mines have been efficiently auctioned for the industrial sale of coal. One other 141 new mines — the best to this point — have been put up for public sale within the newest tranche in November.

Misuse of the bidding course of was not the one approach by way of which firms bypassed competitors in coal mining. Half two of this collection will reveal how the Modi authorities helped one other large company accomplish that by way of one other route.

Kumar Sambhav and Shreegireesh Jalihal are members of The Reporters’ Collective.

Trending

-

Bank and Cryptocurrency11 months ago

Cheap Car Insurance Rates Guide to Understanding Your Options, Laws, and Discounts

-

Bank and Cryptocurrency11 months ago

Why Do We Need an Insurance for Our Vehicle?

-

entertainement5 months ago

entertainement5 months agoHOUSE OF FUN DAILY GIFTS

-

WORD NEWS12 months ago

Swan wrangling and ‘steamy trysts’: the weird lives and jobs of the king’s entourage | Monarchy