WORD NEWS

Pound hits 11-month excessive in opposition to greenback amid US banking turmoil, forward of jobs report – enterprise reside | Enterprise

Introduction: Pound highest in over 11 months in opposition to US greenback

Good morning, and welcome to our rolling protection of enterprise, the monetary markets and the world financial system.

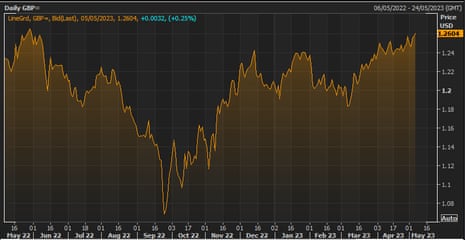

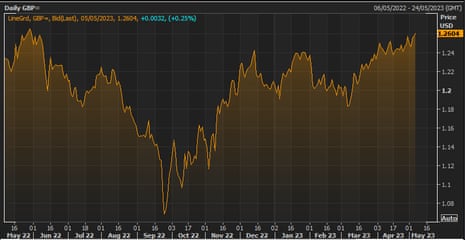

The pound has climbed to its highest degree in opposition to the greenback in virtually a 12 months, as fears over the well being of the worldwide financial system and the well being of US regional banks grip the markets.

Sterling hit $1.263 this morning, up half a cent, to the best degree since late Could 2022. Fairly a restoration since final autumn, when it plumbed file depths round $1.03 after the mini-budget shambles.

The pound is being supported by encouraging financial information this week, displaying a pick-up in UK mortgage functions, service sector progress, and automobile gross sales.

The greenback has weakened regardless of the Federal Reserve lifting US rates of interest to a 16-year excessive this week, with merchants noting that the Fed may quickly finish its tightening cycle.

The Financial institution of England is anticipated to lift rates of interest subsequent Thursday, to 4.5%, with the markets now pricing in a single extra hike earlier than the tip of the 12 months.

At the moment’s US employment report will present if America’s jobs market is cooling. Economists predict 180,000 new jobs have been created in April, which might be a slowdown on March’s 236,000.

Additionally arising immediately

America’s banking sector stays in turmoil, after shares in a number of regional lenders fell once more yesterday.

PacWest Bancorp shed 50% by the shut of buying and selling final night time, with First Horizon shedding a 3rd of its worth. Western Alliance, which firmly denied a report it was exploring a possible sale, misplaced virtually 40%.

PacWest had sought to calm markets on Wednesday and stated it was in talks with a number of potential traders after its shares fell by as a lot as 60%. However the sell-off continued on Thursday and affected different regional banks.

“We imagine the banks are having their GameStop-like second, the place social media is amplifying non-traditional approaches to assessing solvency,” Jaret Seiberg, TD Cowen analyst, wrote in a be aware, including:

“This creates a self-fulfilling prophecy that pressures inventory costs, which then results in extra questions.”

One other financial institution, HSBC, will even be within the highlight immediately because it holds its annual common assembly. Buyers will vote on a decision calling for a derivative of HSBC’s Asia enterprise, backed by high shareholder Ping An, however opposed by the financial institution’s board.

The agenda

-

7am BST: German manufacturing unit orders for March

-

9.30am BST: UK development PMI for April

-

10am BST: Eurozone retail gross sales for March

-

11am BST: HSBC’s AGM

-

1.30pm BST: US jobs report for April

Key occasions

Britain’s monetary watchdog has continued its crackdown on illegally operated crypto ATMs.

The Monetary Conduct Authority has inspected websites in Exeter, Nottingham and Sheffield, in its pushback in opposition to machines permitting prospects to purchase or convert conventional currencies into cryptoassets together with bitcoin.

Therese Chambers, govt director of enforcement and market oversight on the FCA, stated:

“Crypto ATMs working with out FCA registration are unlawful. The motion we’ve taken over the previous few months and wider work exhibits that we’ll act to cease criminality.

“In addition to disrupting unregistered crypto companies, the joint efforts have helped increase consciousness of illegally operated crypto ATMs within the UK among the many public.

“That is particularly essential as crypto merchandise are excessive threat and never presently regulated. Which means you ought to be ready to lose all of your cash in case you spend money on them.”

Scholar: Pound properly supported forward of Financial institution of England price resolution subsequent week

The pound is up over 4% in opposition to the US greenback to this point this 12 months, and up greater than 10% over the previous six months, factors out Victoria Scholar, head of funding at Interactive Investor:

King Greenback, which outperformed in 2022 due to the Federal Reserve’s aggressive stream of price hikes, is shedding its crown because the central financial institution approaches the height of its price mountaineering cycle, lowering the attract of the world’s reserve forex. Different currencies together with the pound have been benefitting from this shift away from the buck. Because the nadir final September after the mini-budget which sharply punished sterling, the pound has been on a tear.

The US greenback is below strain in opposition to the pound, the euro, and the Japanese yen immediately as traders count on a weak jobs report stateside later immediately with 180,000 job creations anticipated in April, the bottom month-to-month achieve since December 2019 earlier than the pandemic.

In the meantime the pound stays properly supported forward of the Financial institution of England’s price resolution subsequent week when the central financial institution is anticipated to lift rates of interest once more to 4.5% having beforehand lifted the financial institution price by 25-basis factors in March to recent 2008 highs.

UK inflation stays stubbornly excessive whereas inflation charges in Europe and the US ease extra rapidly, with UK CPI caught sharply above the two% goal at over 10%.

UK Chancellor’s new adviser warns in opposition to fast repair of tax cuts

Final September, the pound hit its alltime low in opposition to the US greenback after then-chancellor Kwasi Kwarteng introduced unfunded tax cuts within the mini-budget, and promised extra have been on the way in which.

Kwarteng’s successor, Jeremy Hunt, reversed the mini-budget, serving to the pound to recuperate.

And now, the chancellor’s new financial adviser, Anna Valero, is urging Hunt to look past tax cuts to revive Britain’s anemic progress charges.

Valero says Hunt should considerably widen his new enterprise funding stimulus, in an interview with Bloomberg.

Bloomberg explains:

Valero, a senior coverage fellow at London College of Economics’s Centre for Financial Efficiency, warned that utilizing tax cuts as a “fast repair” to spice up progress wouldn’t work and known as for extra beneficiant incentives to spur enterprise funding.

The remarks underscore the competing calls for Hunt faces if he finds cash for giveaways forward of the following common election, which is anticipated in 2024. He’s going through strain from the ruling Conservative Social gathering to cut back the tax burden, which is the best it’s been in many years.

“If it was as straightforward as chopping taxes, then we’d’ve seen that through the years that we had significantly low company tax,” Valero stated in an interview on Bloomberg’s UK Politics Podcast. “The tax setting issues, however there are lots of different issues we should be doing for enhancing progress. Throughout the tax setting, we will be eager about incentives for funding fairly than the headline price.”

Shares have opened increased in London, as share claw again a few of yesterday’s losses.

The blue-chip FTSE 100 index has gained 58 factors, or 0.75%, again to 7760 factors, away from Thursday’s one-month low.

British Airway’s guardian firm, IAG, are main the risers – up 3.6% after elevating its revenue forecasts this morning.

John Moore, funding supervisor at RBC Brewin Dolphin says:

“IAG has delivered its first Q1 revenue since 2019, confirming the departure from the difficult Covid interval. Buying and selling was sturdy aided by the dual forces of decrease gas costs and robust demand; nonetheless, some credit score can also be resulting from IAG’s personal actions and deal with core North American and Latin American markets.

Going ahead, the corporate recognises that there could also be headwinds however improved profitability and the power to decrease debt ought to put it in a strong place.”

Oil giants Shell (+2.5%) and BP (+3%), who each reported bumper income this week, are each among the many high risers too.

German industrial orders tumble

Ouch. German factories have suffered one in every of their greatest falls in new orders in many years, giving the pound a raise in opposition to the euro.

German industrial orders fell by 10.7% month-on-month in March, considerably greater than the two.2% fall anticipated.

It’s the largest fall since demand slumped in April 2020 early within the Covid-19 pandemic.

Orders from abroad tumbled by 13.3%, indicating international demand weakened, whereas home orders decreased by 6.8%.

Commerzbank chief economist Joerg Kraemer stated.

“After three will increase in a row, new orders actually collapsed in March, thus resumed their downward development,”

“Growing dangers for the export-oriented German business come from the worldwide rate of interest hikes. As well as, the impetus from working off orders that had been caught resulting from a scarcity of supplies is waning.

Wow, -10.7% decline in Germany manufacturing unit orders vs -2.3% anticipated, highlighting a lot decrease demand for items from the European largest financial system.

There have been solely two occasions within the final 30+ years when German manufacturing unit orders fell by a bigger quantity – Covid and 1991. pic.twitter.com/CiM0aR7GJM

— Sergei Perfiliev 🇺🇦 (@perfiliev) Could 5, 2023

The pound has risen to a one-month excessive in opposition to the euro, at €1.143.

Swiss financial institution UBS predicts the US greenback will weaken additional in opposition to different main currencies over the following six to 12 months.

That’s as a result of the US Federal Reserve might pause its rates of interest hikes sooner than different main central banks, with the US financial system vulnerable to recession.

Mark Haefele, chief funding officer at UBS International Wealth Administration, explains:

“With the US financial system shedding its progress benefit and the speed premium prone to slim, we advise traders to hedge their greenback publicity, favoring the Australian greenback, the yen, and gold.”

Introduction: Pound highest in over 11 months in opposition to US greenback

Good morning, and welcome to our rolling protection of enterprise, the monetary markets and the world financial system.

The pound has climbed to its highest degree in opposition to the greenback in virtually a 12 months, as fears over the well being of the worldwide financial system and the well being of US regional banks grip the markets.

Sterling hit $1.263 this morning, up half a cent, to the best degree since late Could 2022. Fairly a restoration since final autumn, when it plumbed file depths round $1.03 after the mini-budget shambles.

The pound is being supported by encouraging financial information this week, displaying a pick-up in UK mortgage functions, service sector progress, and automobile gross sales.

The greenback has weakened regardless of the Federal Reserve lifting US rates of interest to a 16-year excessive this week, with merchants noting that the Fed may quickly finish its tightening cycle.

The Financial institution of England is anticipated to lift rates of interest subsequent Thursday, to 4.5%, with the markets now pricing in a single extra hike earlier than the tip of the 12 months.

At the moment’s US employment report will present if America’s jobs market is cooling. Economists predict 180,000 new jobs have been created in April, which might be a slowdown on March’s 236,000.

Additionally arising immediately

America’s banking sector stays in turmoil, after shares in a number of regional lenders fell once more yesterday.

PacWest Bancorp shed 50% by the shut of buying and selling final night time, with First Horizon shedding a 3rd of its worth. Western Alliance, which firmly denied a report it was exploring a possible sale, misplaced virtually 40%.

PacWest had sought to calm markets on Wednesday and stated it was in talks with a number of potential traders after its shares fell by as a lot as 60%. However the sell-off continued on Thursday and affected different regional banks.

“We imagine the banks are having their GameStop-like second, the place social media is amplifying non-traditional approaches to assessing solvency,” Jaret Seiberg, TD Cowen analyst, wrote in a be aware, including:

“This creates a self-fulfilling prophecy that pressures inventory costs, which then results in extra questions.”

One other financial institution, HSBC, will even be within the highlight immediately because it holds its annual common assembly. Buyers will vote on a decision calling for a derivative of HSBC’s Asia enterprise, backed by high shareholder Ping An, however opposed by the financial institution’s board.

The agenda

-

7am BST: German manufacturing unit orders for March

-

9.30am BST: UK development PMI for April

-

10am BST: Eurozone retail gross sales for March

-

11am BST: HSBC’s AGM

-

1.30pm BST: US jobs report for April

Trending

-

Bank and Cryptocurrency11 months ago

Cheap Car Insurance Rates Guide to Understanding Your Options, Laws, and Discounts

-

Bank and Cryptocurrency11 months ago

Why Do We Need an Insurance for Our Vehicle?

-

entertainement5 months ago

entertainement5 months agoHOUSE OF FUN DAILY GIFTS

-

WORD NEWS12 months ago

Swan wrangling and ‘steamy trysts’: the weird lives and jobs of the king’s entourage | Monarchy